This strategy is already common in finance and it’s becoming table stakes across SaaS.

Bessemer Venture Partners underscored in 2022 that:

“indirect monetization is an extremely effective way to build a business, and given the increasingly competitive SaaS markets, this strategy is becoming table stakes.” Examples of businesses that lean into indirect monetization are Brex, Built, and Ramp.

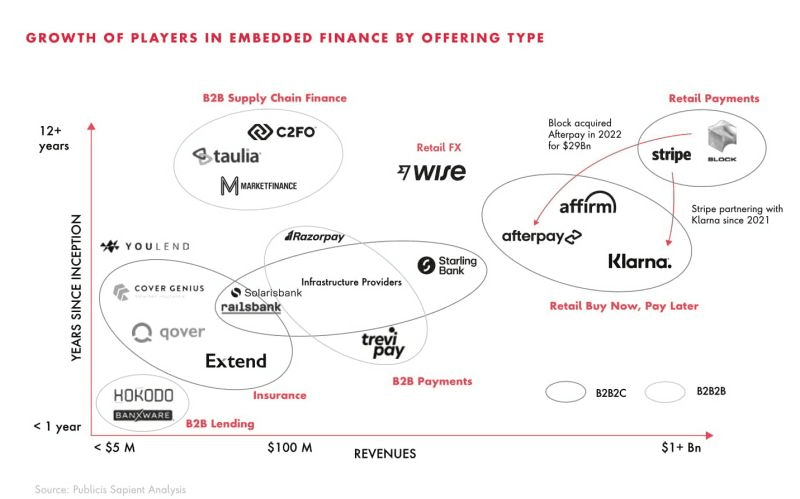

🗽 The trend is prominent in finance, where embedded finance is to 4X from $41B in 2021 to $160B in 2025 (Publicis Sapient)

Among digital champions in banking:

93% offer API

83% partner w/ fintechs

for banking laggards, figures are lower - 77% and 61% respectively (Deloitte).

💡 We discussed the API-embed trend on the example of embedded insurance with Andy Bodrog, who is leading partnerships in Cover Genius.

He explained how API-embedded insurance works and how it’s different from “traditional” referral partnerships:

“People have trusted brands they use and like. When there's a new offer on that trusted brand, if it's an embedded add-on product, you trust the brand, and you purchase it. With the insurance world, this is the newest distribution strategy with the proliferation of API's. It's supposed to grow 5-10x in the next 10 years.

You're on Airbnb or on Booking.com, the hotel cancellation protection etc. is an add-on that's much simpler and higher converting than any type of other relationships that are a referral link in an article…”

👀 Is embedded partnerships strategy for everyone and how vendors offer it?

“A company might begin with a referral link type of partnership, and it's a good start. But if they're digitizing, and their core product lends itself to an embedded solution, then it's usually more optimal…

We're [CG] partnering on one side with the carrier, where we're getting the insurance product from. We're able to go to a company [prospect] and say, we have every insurance product that you might need, we're not an off-the-shelf company’. We're not, “hey, we have these five products, let's partner around one of them”. We're able to really be a consultant to that partner and solve a problem that they might not be able to find a solution or don't really even know the solution.

Autodesk is a great example. The company has a SaaS product, and engineers use its software to design buildings or products. It might have insurance carrier relationships on a commercial level. But what if it wants to add insurance to the engineers or the architects who use its program. It has millions of customers, but might not know what products are relevant or how can we add this to the digital subscriptions? That's where embedded insurance would come in…

Read/watch full episode from referrals to API embedded partnerships in insurtech

🏆 Check all 7 insights of 2022 here.

Latest Insights & Analysis

We help our clients to define customer-centric strategies that stimulate innovation and create value