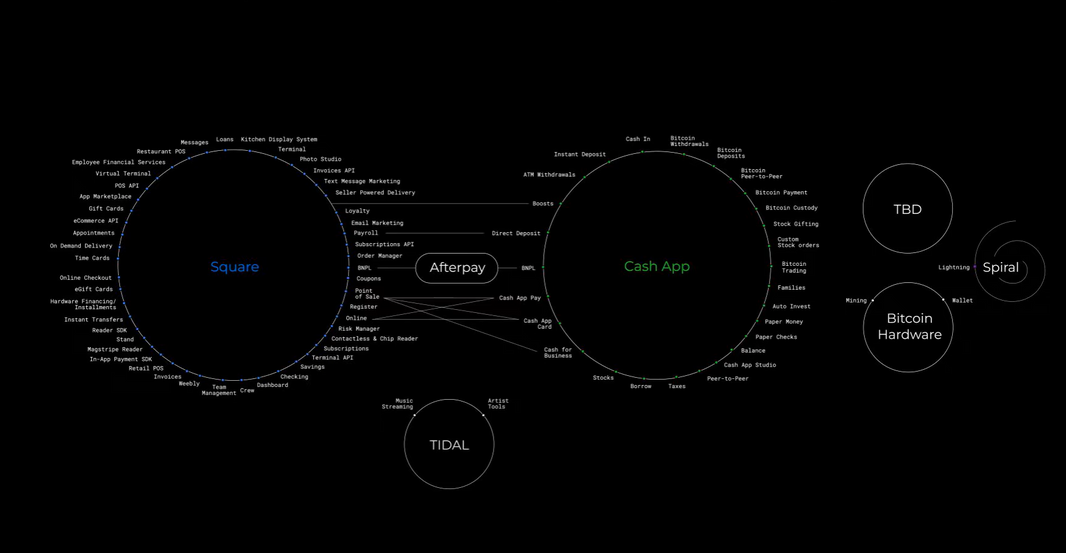

An ecosystem of ecosystems?

- Oct 2, 2022

- 2 min read

“We're building an #ecosystem of ecosystems” - Jack Dorsey.

💡 It’s insightful to hear from one of the most visionary people in tech, why in Block he's betting on product ecosystem so much.

💬 We started Square at the beginning of 2009 with one goal - make a credit card reader anyone could use, with the tool they already had - their mobile phone.

A few months after that, we realized we actually weren't making a credit card reader, we're making a service to help a seller make a sale. That insight expanded the scope of the problem significantly, especially as we asked the follow-up question. How do we help a seller make more sales?

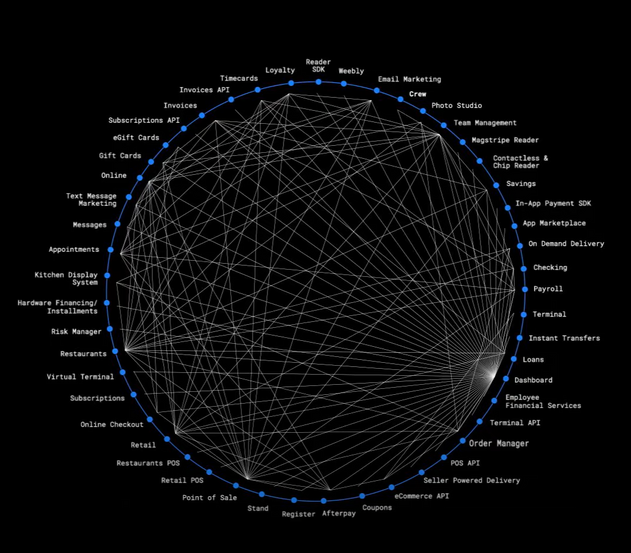

The answer to that question led us to a suite of tools and services:

✔️ from a full register

✔️ to POS software for retailers, restaurants and services;

an online store

✔️ invoices

✔️ customer relationship employee and location management,

✔️a debit card and banking tools,

✔️ loans

✔️ and a full-fledged developer platform to extend beyond what we've built.

We call what we've built for sellers 📌 an ecosystem - that is a set of hardware and software tools and services that work together, often positively reinforcing one another, creating a resilient customer relationship.

In the past, sellers would have to hook up all these tools themselves to run their businesses. We decided to take all that complexity away, handle it ourselves and give sellers time back.…

💎 It also gave us resiliency - sellers may hire us to do three or four jobs for them. If they aren't satisfied with one, they can fire us for that one, but they aren't firing our entire company. They may not use us for a loan, but will continue to use us for software, payments, register and CRM. It gives us time to address the issues for the service they fired, and perhaps in the future they will re-hire us for that one too.

In 2013 we launched another product called Cash App.

Initially it was an email product, you can send an email to anyone, cc’ pay@square.com and put the amount you wanted to send in the subject line or body. And it worked instantly, because we pushed that money to the debit card the recipient entered. Eventually we converted it into an app and worked on growing the network and finding a modernization model.

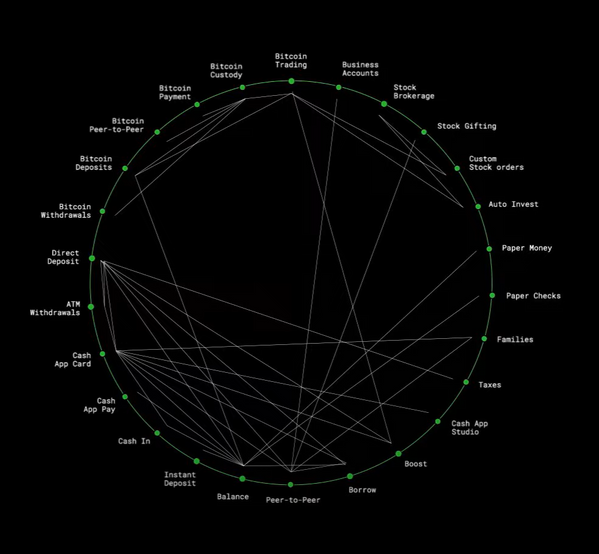

That exploration led us to building:

✔️ a way to store a balance with us

✔️ pay for instant deposit

✔️ issue a visa card that also worked at ATMs

✔️ direct deposit

✔️ a bitcoin exchange

✔️ fractional stock purchases

✔️ taxes

✔️ an instant rewards program

✔️ and lending

Once again, we got to an ecosystem of services that all work together. This time for a different audience - consumers….'

🔗 Now Block is tying together these ecosystems.

"The more connections between our ecosystems we create, the more resilience our overall company enjoys in addition to competitive advantages."

Source: Block's Investor Day '22.