This is the power of platforms.

Cloud platforms generate 30X value vs cloud applications

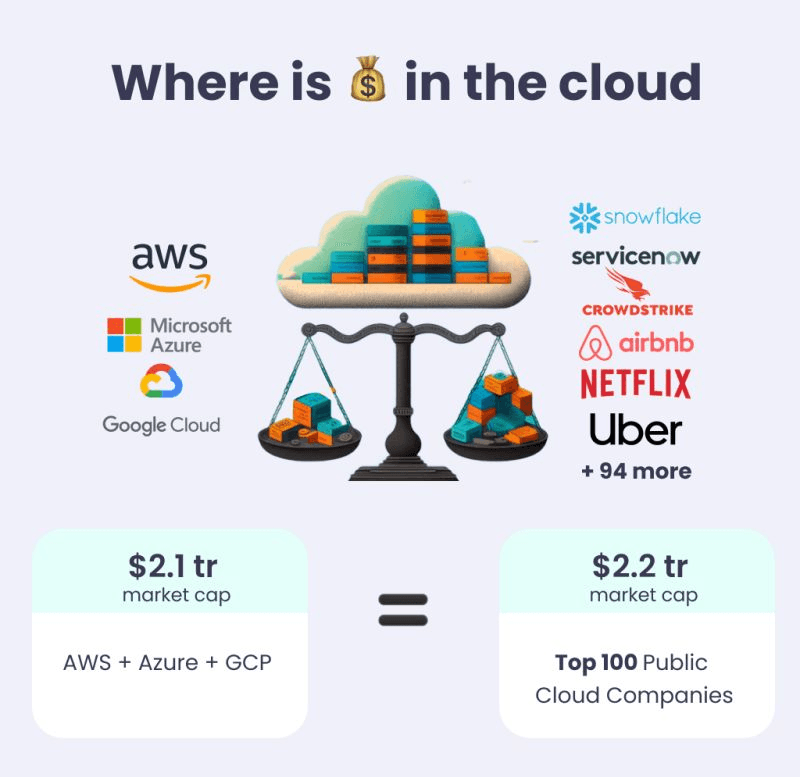

💬 Looking at publicly trading Cloud companies, we can determine which layer accrues the most value...

If you take the 100 publicly traded cloud companies, both B2B and B2C, and you put their market caps together, you get roughly the same amount. This includes companies like Uber, Netflix, Airbnb, Snowflake, ServiceNow, CrowdStrike, etc..

At the infrastructure layer you can generate as much value as you can at the application layer, but the major difference is the number of companies.

At the infrastructure layer, there is significantly more concentration because it takes a lot more money to build these platfrms. Infrastructure takes a lot of money to buy servers and rent data centers.

Thanks for sharing Tomasz Tunguz @Redpoint Ventures

🤝 What’s interesting though, is that cloud infrastructure companies are hardly self-sufficient. To attract and retain users, they need thousands of SaaS applications that would solve millions variations of user needs. AWS famously says that it takes 15 services to get to the user outcome.

This rule of customer-centric value creation is prompting hyperscalers and application developers to engage in collaboration at scale. This includes hyperscalers bringing apps to their marketplaces as many and as fast as possible.

Latest Insights & Analysis

We help our clients to define customer-centric strategies that stimulate innovation and create value