Why leaders like CrowdStrike choose to transact there? Let’s take a look.

🗽 On the path to $1Tr

Even in stringent times companies are opting for a cloud-first strategy, pushing the cloud market forward.

End-user spend on public cloud is about to reach ~$600billion in 2023 (Gartner)

Total spend on cloud, hardware, software + services around will reach $1.3 Tr by 2025 (IDC)

Hyperscalers leverage this spend, now controlling 2/3 of the global market

AWS -34%, Azure - 21%, Google Cloud - 11%.

But they are not doing it alone - they're scaling 3rd party marketplaces to attract users and increase spend on their cloud, . These cloud marketplaces are now the fastest growing channel in SaaS - to 5X by 2025 (BVP).

🛒☁️ Marketplaces go to cloud

Cloud marketplaces have been around for ~10 yrs, but recently hyperscalers made them center pillars of their partner strategies.

Google Cloud’s Corporate VP, Global Ecosystem and Channels, Kevin Ichhpurani wrote a few weeks ago:

“We believe you cannot be customer-centric if you are not also partner-centric… we’ll continue to evolve Google Cloud Marketplace as the go-to destination for our partners and customers to deploy enterprise applications”.

Within the cloud spend, SaaS is the biggest contributor (30% of $600B), so marketplaces are attracting SaaS companies who need to be where their customers are.

Like e-commerce vendors had to decide whether to list on Amazon or build their own distribution on Shopify, etc. many SaaS vendors are now going through the same journey.

⚖️ How big are marketplaces already?

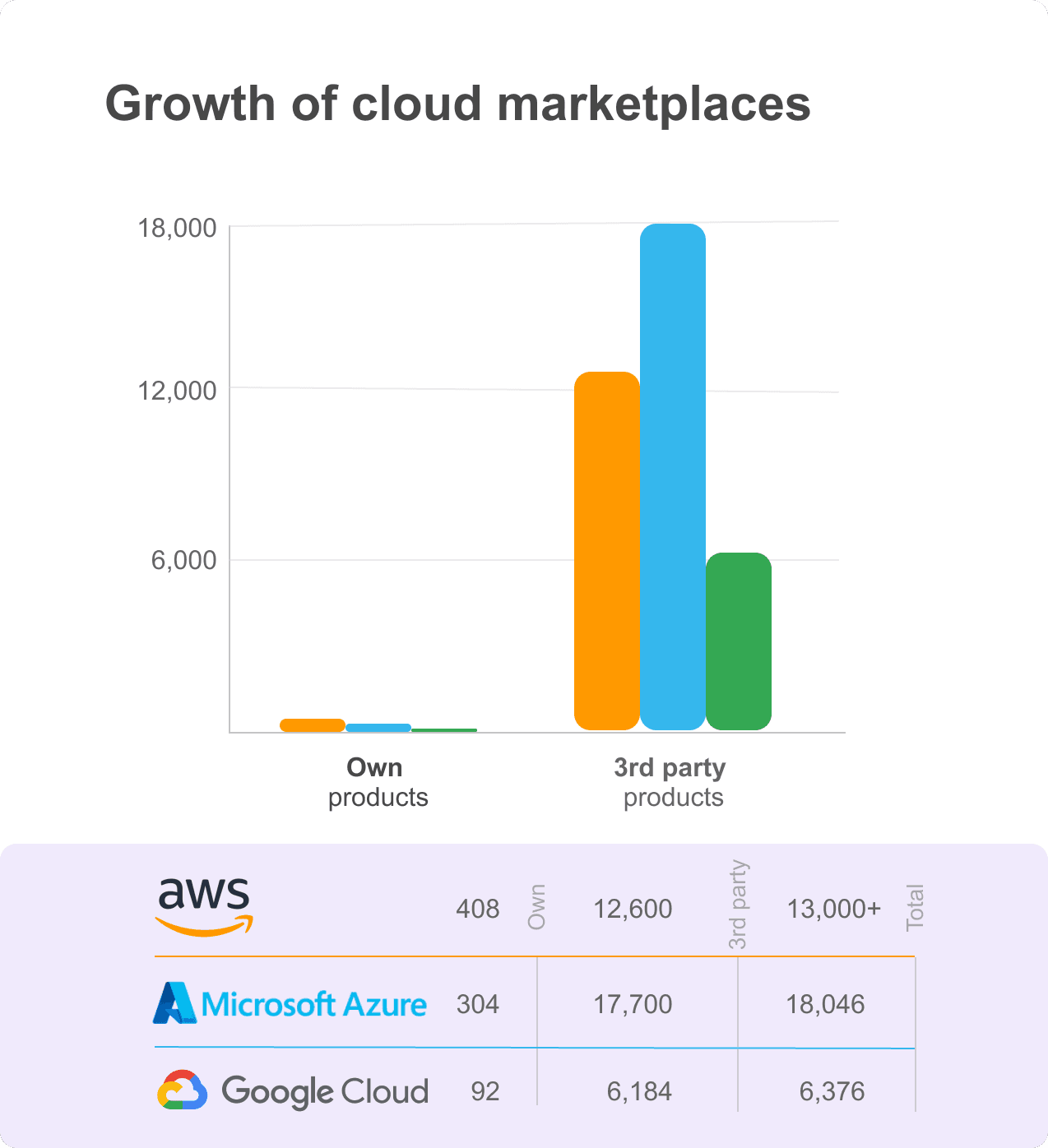

New marketplaces already dwarfed the first B2B SaaS app stores - compare figures on the graph with 3K+ apps on Salesforce AppExchange.

AWS facilitates $1Bn+ of transactions per year, including $XX M deals via marketplace. CrowdStrike is growing 100% YoY on AWS - and while the volume is still ~ 3% of their total revenue, it’s $100M just in one company.

MSFT recently boasted closing $100M via their marketplace in a week across a few deals.

🎁 Private offers, Cloud credits & Private Marketplaces

Just like in B2C, marketplaces started with direct transactions, but what unlocked their growth are:

Introduction of private offers - sellers can create special pricing/terms for buyers

Cloud credit count towards (some) marketplace purchases - hence discounts, etc.

Adding Consulting & Channel Partners - sellers can now work pay partners via marketplace. Canalys expects channel partners to drive 1/3 of procurement via marketplaces.

What working in cloud marketplaces already

Unified bill - happy procurement, fast process, no extra research required

Cloud credits - buyers can buy 3rd party apps with credits (MSFT announced that all purchases count)

Very easy for customers to try new SaaS

Multi-year deals - 2/3 of MSFT deals via marketplaces are now 3Y contracts

If sellers register deals, hyperscalers sales teams can help to enter and close large deals, especially for recognized customers.

High growth potential - see the numbers above

Friendly fee - 3% (especially comparing with B2C counterparts)

Partner Private Offer programs accelerated purchases a lot allowing participants to create bespoke offerings with customer-specific pricing and statements of work.

What’s not working

Discovery - customers don’t yet discover software via cloud marketplace at scale. This means that listing isn’t nearly enough, you need to bring your own buyers too.

You need to jump though hoops to get vetted and listed,

You need to create a very tight Better Together story to get traction

While everyone wants to co-sell with hyperscalers and loop their sales teams to help, you need to have large deals or strong brand recognition to get them really excited.

From our Q&A with Jay McBain of Canalyst

Roman Partner Insight:

Marketplaces are changing the partnership landscape quite significantly. At the same time, I had a chance to speak with a senior leader in Amazon asking if he thinks that AWS will completely change the landscape for channels and partnerships. He answered that actually, maybe it will have a large impact, but it will not change everything. Because so many companies are now moving to the cloud, there's going to be more and more software. There's going to be still a lot of different partnership models and collaborations outside of marketplaces. What do you think?

Jay McBain of Canalyst

It’s a big topic, but at the high level, McKinsey is talking about B2B marketplaces, dragging $17 trillion by the end of the decade.

We're calling on 86% compounded growth and marketplaces at Canalys over the next number of years, they are growing on a hockey stick.

The fact of the matter is our industry is also growing. In this decade, our industry doubles from 4.3 trillion to 8.6 trillion of what businesses and governments spend on technology.

What ends up happening is marketplaces aren't killing anyone. Distributors continue to grow, even though AWS we predicted will become a top 10 distributor within the next couple of years.

We have direct, which continues to be a big chunk. We think maybe by the end of the decade, marketplaces might be 1/3 of the economy, that's a couple of trillion dollars, that's big, but resell and through distribution, everything else is still going to be a couple of trillion dollars. It's just not going to grow as fast as marketplaces are.

But to any company, you have to figure out your go-to-market strategy, your routes to market. If you're a SaaS company, you've got to figure out how many of your customers want to exercise enterprise credits at Microsoft, AWS, Google, Salesforce, HubSpot, whichever marketplace they're on.

If they want to buy your software as part of a seven layer stack, which is today's average, you got to create a frictionless way to do that. If you make them buy direct, or if you make them buy through a reseller, when they want to buy through a marketplace, you're going to lose deals because of that.

And you're going to gain more deals if you're through a marketplace and make it frictionless. You're gonna win deals from the competition because you do it better than they do.

So marketplace has to be viewed as an expansion of your routes to market. And also complementary, because it also serves beyond the point of sale - some marketing help, some retention help, there's some other things that marketplaces do as well as a benefit.

But again, it doesn't kill anyone, we're not selling magazines here. There's the death of nothing. Everything grows, it just grows at different paces.

And as partner professionals, we have to view it as a broadening of the landscape, kind of like distribution is broadening as well into different layers, This is going to just be a very large, distributed environment, some of it indirect, some of it direct, and, you know, good chunk of growing through marketplaces.

Read more insights on how to win in cloud marketplaces

Sources: Companies, Gartner, IDC, Statista, etc.

Additional reading:

Latest Insights & Analysis

We help our clients to define customer-centric strategies that stimulate innovation and create value